Investment Highlights

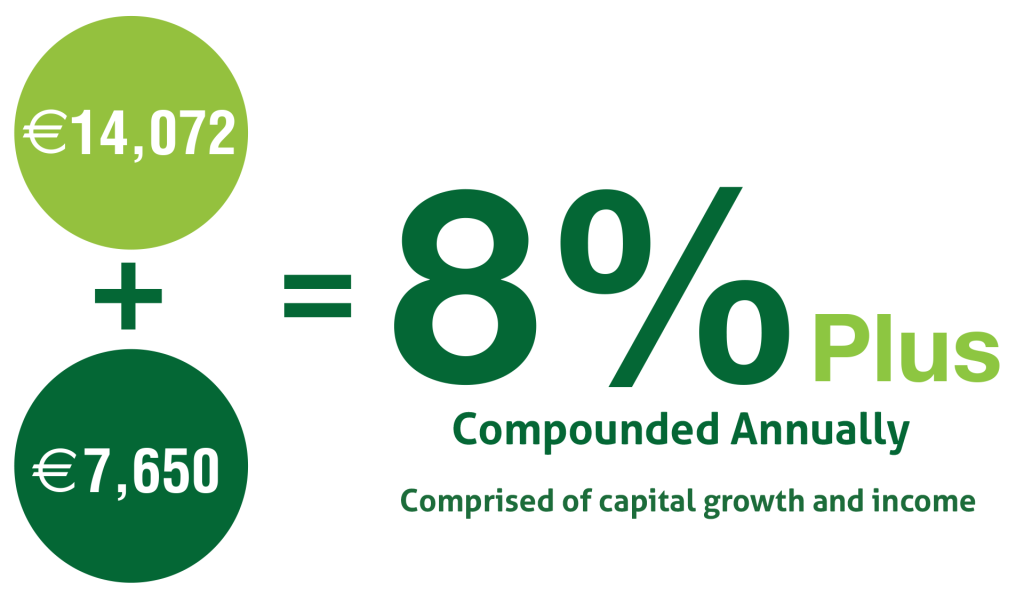

- 8% plus return compounded per annum on the capital invested over the lifetime of the investment.

- 5.1% Gross annual income.

- Tax exempt income as Government backed forestry grants are tax exempt.

- World beating growth rates as Ireland’s optimum growing conditions provide some of the best growth rates in the world which are the main driver of forestry returns.

- Biological growth is always positive thus preserving value during times of financial market turmoil.

- Performance independent of financial markets biological growth of forestry is independent of all economic factors that affect financial markets.

- Proven management team have track record of successfully procuring, establishing and managing forestry plantations.

- Substantial investment opportunity due to the lack of new forestry plantations to meet future demand a compelling investment opportunity.

- Investment risk factors are mitigated with careful site selection and ongoing management mitigate the productivity risk.

- Rigorous forestry regulation ensures Ireland is one of the lowest risk locations in the world to invest in commercial forestry.

- Diversified Portfolio of plantations ensures investor’s funds are spread over multiple plantations at any one time reducing risk exposure.

- Hedges against inflation risk as historically forestry was an effective hedge against inflation.

- Imminent Market Supply shortage from credible research institutes show critical supply shortage.

SIFF INVESTMENT PROCESS

- Identify highly productive sites: SIFF Asset Managers identify highly productive sites using cutting edge scientifically backed software called Geographic Information System – GIS.

- Apply for planting and grant approval: SIFF Asset Managers apply to the Forest Service for planting and financial approval for the Site.

- Purchase Site: Once planting and grant approval has been given by the Forest Service and the relevant Conveyancing work is completed the site is purchased by SIFF asset managers on behalf of investors.

- Establish Forestry: Forestry plantation is established in compliance with the guidelines set out by the Department of Agriculture and is checked by the Forest Service to make sure the forestry plantation meets these guidelines.

- Ongoing Management: The Forestry plantation is professionally managed to maturity on year 15 so achieving the maximum potential return for investors. Our intensive management strategy mitigates the risks that affect the productivity of the forestry plantation so increasing returns.

- Sale of forestry plantation: On maturity of the investment the semi mature forestry plantation is sold and the residual profits paid to the shareholders.

Terms of SIFF

- SIFF is a Limited Partnership (LP) established and tax resident in Ireland.

- LP is a low-cost structure, tax efficient and in a regulated environment.

- Investors subscribe capital for shares in the partnership.

- Investors have limited liability up to the amount invested.

- 100% ownership of forestry assets by investors.

- Annual distribution paid to investors from forestry grants less Fund expenses.

- Final distribution paid from the sale of semi-mature forestry.

- No investment lock in – shares in partnership are transferable at any time.

- No Leveraging.

- 2% annual management charge.

- 6% set up fee – to cover stamp duty, legal fees, professional fees and related marketing and administration costs.

- 20% performance-based bonus only on returns in excess of 8% gross compounded annual return.

- Asset-backed investment.

- Detailed terms and conditions set out is Limited Partnership Agreement available on request from SIFF asset management.

8% plus

Investor

preferred

return.

World

beating

Growth rates.

5.1%

Gross

Annual

Income

Tax

Exempt

Income.